Beginning a New Chapter: The Intricate Dance of Financial Management and Mental Health in College

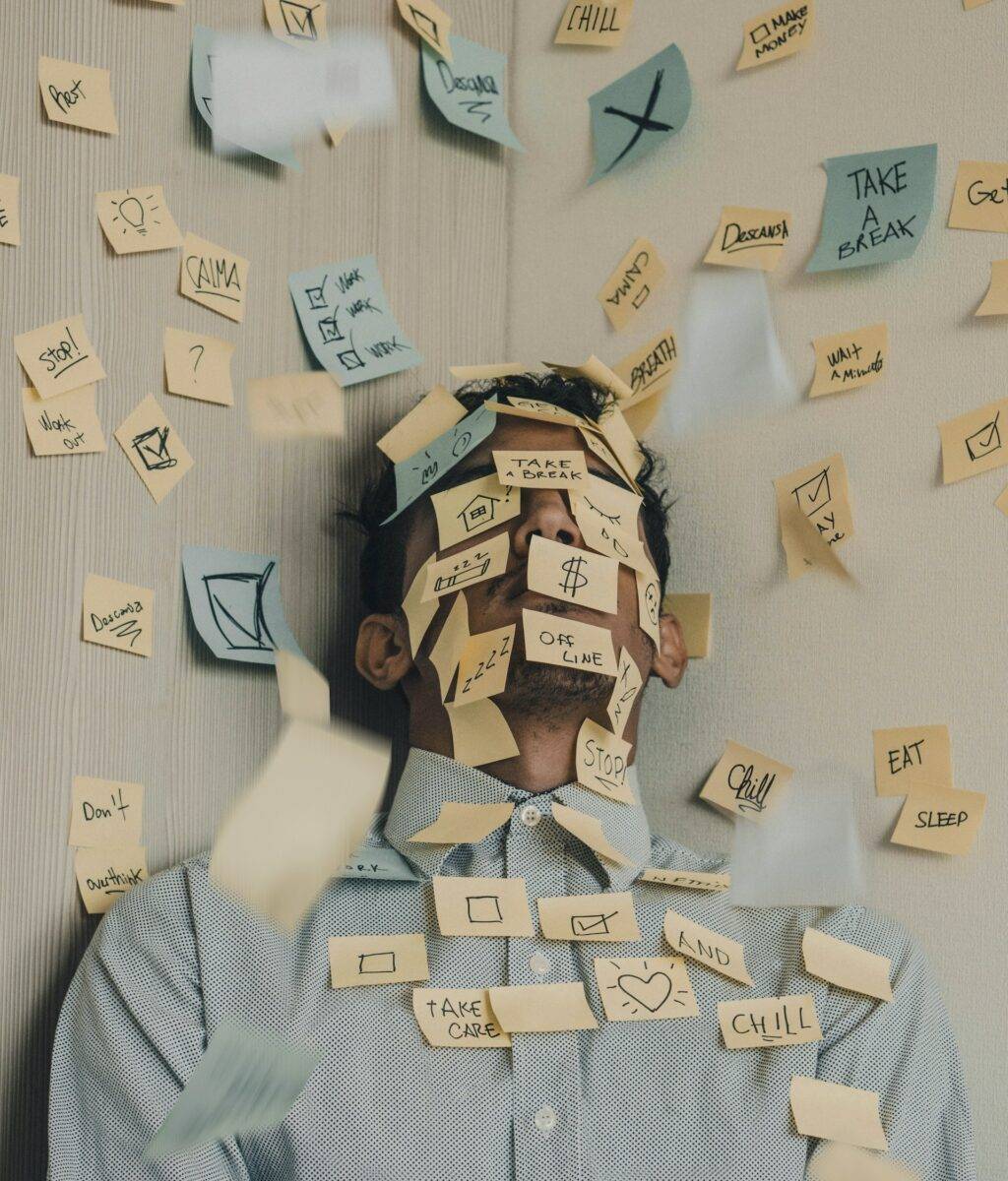

Breathing in the exhilarating air of a new chapter, college students find themselves in a vortex of transformation. Among the whirlwind of excitement lies an often grim reality—balancing an intricate equation of tuition fees, living costs, and personal expenses. Let’s dive into a multi-dimensional exploration of circumventing this financial stress in college, with a keen eye on two central themes: budgeting and mental health.

Unraveling the Labyrinth of Financial Stress in College

At the heart of the collegiate experience, financial stress dances like a wily minotaur in a labyrinth of monetary responsibilities. From towering tuition fees to escalating student loans, from meager income to deficient budgeting expertise—it’s an emotion-laden saga, varied as the students themselves. To navigate this maze successfully, one must recognize the far-reaching effects of financial stress on a student’s holistic well-being and scholarly excellence.

The Artistry of Budgeting

Honing the craft of budgeting could be a lighthouse in the stormy seas of financial management. It endows students with a sturdy anchor—control over their outflows, cognizance of their spending patterns, and the power to make informed monetary decisions. A well-forged budget can lay a solid foundation for fiscal planning, successfully thwarting unexpected financial ambushes.

Sculpting a Financial Blueprint

Crafting an effective budgeting blueprint involves an intricate process:

1. Charting Monetary Objectives: Embark on your journey by pinning down immediate and long-range financial goals, such as college fees savings, living expense management, or debt reduction. A clear finish line can provide motivational fuel, keeping students on track.

2. Expense Surveillance: Keep a watchful eye on all expenses, from tuition to entertainment. Harness the power of modern tools like budgeting apps or spreadsheets to keep your income-expenditure balance in check.

3. Trimming the Excess: Dissect your spending habits and spot areas ripe for pruning. Perhaps it’s the frequent dining out, shopping sprees, or daily essentials—every penny saved adds to your financial arsenal.

Tactics to Counteract Financial Stress

Budgeting, although powerful, is one piece of the puzzle. Other weapons in the armory to combat financial stress include:

1. Scholarships and Grants: College or external organizations often present a treasure trove of scholarships and grants, a significant relief for the tuition fee burden.

2. Part-Time Jobs and Internships: Opportunities that resonate with academic pursuits or career aspirations can provide additional funds and professional skills—two birds with one stone.

3. Student Loan Management: If student loans are a reality, comprehending the terms and repayment alternatives is key. Architecting a repayment blueprint and investigating loan forgiveness schemes or income-oriented repayment options can be vital.

The Safety Net of Financial Aid and Resources

The academic world is brimming with lifelines to aid students grappling with monetary difficulties. Seek out the financial aid office and discover options like emergency funds, interest-free loans, or work-study schemes. Moreover, online financial literacy workshops or courses can offer essential guidance for money management.

Unveiling the Intersection of Financial Stress and Mental Health

The tendrils of financial stress reach deep into the psyche, instigating anxiety, depression, and a general decline in wellness. Recognizing this connection is paramount for students to cultivate mental health alongside financial discipline.

Balancing the Scales with Self-Care and Mental Health Strategies

To mitigate the effects of financial stress, mental well-being must be given equal importance:

1. Building a Support Network: Surround yourself with a protective circle of well-wishers—friends, family, mentors—who can lend emotional strength in turbulent times.

2. Seeking Professional Guidance: If monetary stress begins to significantly erode mental health, it’s crucial to turn to mental health professionals. They can equip you with coping strategies tailored to your unique needs.

Preserving Financial Wellness: A Few Pointers

To maintain financial equilibrium throughout college, keep the following tips in mind:

Regularly revisit and tweak your budget to mirror evolving circumstances.

Opt for free or budget-friendly entertainment alternatives.

Harness student discounts available across various products and services.

Stay organized with bill, rent, and other payment deadlines.

Explore used books or alternative academic resources to save on textbooks.

Wrapping Up

The dance of navigating financial stress in college demands strategic choreography involving planning, budgeting, and nurturing mental health. Implementing effective budgeting techniques, leveraging available financial aids, and ensuring mental health, students can sidestep unnecessary stress and remain focused on academic triumphs. Remember, reaching out for help is a display of strength, not weakness, and countless resources stand ready to guide you on this journey.

FAQs

How does budgeting combat financial stress in college? Budgeting gives students the reins of their expenses, empowers them to make informed monetary choices, and spot areas for cost-cutting. A well-crafted budget provides control, reduces financial stress, and facilitates future planning.

What resources exist for students facing financial hardship in college? Numerous resources such as emergency funds, interest-free loans, or work-study programs are available at many colleges and universities. Consulting the financial aid office or enrolling in online financial literacy workshops can provide further support.

Can college financial stress impact mental health? Yes, financial stress can significantly impact mental health, inducing anxiety, depression, and overall deterioration in well-being. Therefore, it’s critical to balance financial responsibilities and mental health.

How can students lighten their financial load in college? Students can alleviate their financial burden by applying for scholarships and grants, undertaking part-time jobs or internships, and managing student loans effectively. Additionally, exploring financial aid and resources offered by colleges and universities can offer substantial relief.

What steps should students take if financial stress severely impacts their mental health? If financial stress starts taking a significant toll on mental health, it’s crucial to seek help from a mental health professional. Therapy or counseling can provide invaluable coping mechanisms and support catered to individual needs. Seeking help is an indication of strength, and plenty of resources are at hand to assist students.